Why the Forbearance Program Changed the Housing Market

Friends, do you remember when the pandemic hit in 2020? Well, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over a decade ago. Thankfully, the forbearance program changed that.

Here’s why forbearance worked.

- Forbearance provided much-needed relief for homeowners so a foreclosure crisis wouldn’t happen again.

- Forbearance enabled nearly five million homeowners to get back on their feet in a time when having the security and protection of a home was more important than ever.

- Those in need were able to work with their banks and lenders to stay in their homes rather than go into foreclosure. Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA), notes:

“Most borrowers exiting forbearance are moving into either a loan modification, payment deferral, or a combination of the two workout options.”

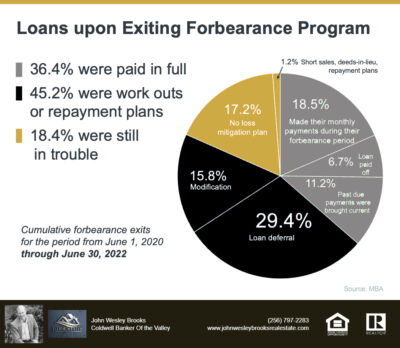

As the graph below shows, with modification, deferral, and workout options in place, four out of every five homeowners in forbearance are either paid in full or are exiting with a plan. They’re able to stay in their homes.

What does this mean for the housing market?

Since so many people can stay in their homes and work out alternative options, there won’t be a wave of foreclosures coming to the market. And while rising slightly since the foreclosure moratorium was lifted this year, foreclosures today are still nowhere near the levels seen in the housing crisis.

Forbearance wasn’t the only game changer, either. Friends, the lending standards have improved significantly since the housing bubble burst, and that’s one more thing keeping foreclosure filings low. Today’s borrowers are much more qualified to pay their home loans.

Nationwide, while the majority of homeowners are exiting the forbearance program with a plan, for those who still need to make a change due to financial hardship or other challenges, today’s record-level of equity is giving them the opportunity to sell their houses and avoid foreclosure altogether.

Today, homeowners have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Thanks to their equity and the current undersupply of homes on the market, homeowners can sell their houses, make a move, and not have to go through the foreclosure process that led to the housing market crash in 2008.

Thomas LaSalvia, Chief Economist with Moody’s Analytics, states:

“There’s some excess savings out there, over 2 trillion worth. . . . There are people that have ownership of those homes right now, that even in a downturn, they’d still likely be able to pay that mortgage and won’t have to hand over keys. And there won’t be a lot of those distressed sales that happened in the 2008 crisis.”

What Is The Bottom Line?

Hey friends, now that you can see how the forbearance program was a game changer for homeowners in need, you could have a little peace over our current real estate market starting to shift in many States in our country.

In fact, the forbearance program is one of the big reasons why we won’t see a wave of foreclosures coming to the market any time soon.

Huntsville Alabama is one of the most desired areas to live in. Our real estate market is still strong and we don’t see too many cases of homes under foreclosure. If you are curious to know more about our current real estate market keep an eye on our local monthly market stats. We have videos uploaded weekly on our YouTube channel.

Again, if you need a trusted and committed full time Real Estate Professional in our North Alabama, make sure you give us a call. The Brooks Family Of Realtors has been serving the North Alabama Families Since 1972.

John Wesley Brooks

John Wesley Brooks